Showing top 0 results 0 results found

Showing top 0 results 0 results found

Live chats have revolutionized how financial service companies communicate with customers in recent years. It made conversations faster, better, and more convenient, ultimately contributing to building strong customer relationships. Live chat is a potent tool for financial institutions, offering real-time engagement, efficient support, and the potential to boost sales.

This article takes a deep dive into the practical benefits of live chats, their use, and ways financial companies can apply them to elevate the overall customer experience.

Why live chat software is a good option for financial services?

Establishing effective communication channels is crucial for the success of financial service providers. Live chat is a strategic choice offering a range of features beyond traditional customer support, making it an invaluable tool in today’s market.

Here are some reasons why live chat for financial services is a good option.

Proactive communication

Live chat goes beyond traditional customer support by adopting a proactive approach. When a customer lands on your website, the live chat initiates a conversation through a preset or lets you to engage with them directly.

This proactive communication is a welcoming gesture and allows you to guide your website visitors, ensuring they have a more personalized interaction. By doing this, live chats allow you to establish an instant connection with the visitor and convert leads into clients from day one.

Seamless multi-channel communication

Live chat adds another layer of convenience for customers by integrating with popular messaging platforms like WhatsApp Business, Apple Messages for Business, and Messenger. Customers have varying communication preferences, so offering this option allows them to engage with you where they are most comfortable.

But multi-channel communication is not just about meeting customers on their preferred platforms – it's about creating a seamless experience for them. Live chat software allows a smooth transition of context and information from one platform to another, regardless of whether it started on your website or another communication channel.

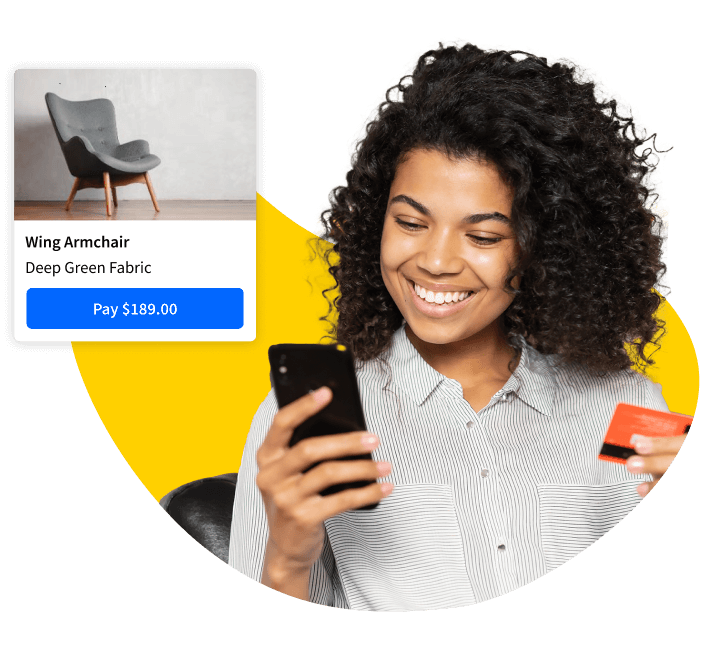

Ecommerce integration

Integrating live chat with leading ecommerce platforms allows you to send in-chat product recommendations based on the current customers' preferences and browsing history. This creates an interactive environment where customers can explore financial products and services in real time while receiving personalized assistance.

Understanding potential customers' behavior and tailoring recommendations is the essence of this feature. Suppose a customer is interested in certain investment products. In that case, the live chat system can intelligently suggest related offerings, providing a holistic view of what is available and how much it costs. This customer-centric approach makes the sales process easier and more personalized.

Streamlined operations with automation

AI has transformed the operational efficiency of financial services through features like AI assist, chat summary, and live assistant.

- AI assist reduces the time it takes to address customer queries by automating responses.

- Chat summary helps agents review and act faster by summarizing and condensing information.

- Live assistant suggests instant replies based on knowledge sources, streamlining the response process.

By automating basic communication, live chat frees up valuable human resources and allows them to focus on more complex issues.

Automation also provides a strategic advantage by handling routine tasks in surroundings where complex and fast problem-solving is an everyday task. It doesn't replace human expertise but complements it, ensuring financial companies use their workforce optimally.

Data-driven decision making

A live chat provides access to detailed reports with insights into customer interactions. These reports provide valuable metrics for assessing customer engagement, response times, and overall chat performance without needing data analysts.

Analyzing this data helps you understand customer behavior, identify pain points, and recognize the areas of excellence. For instance, if a query takes longer to resolve consistently, it indicates the staff needs additional resources or training. In contrast, if some agents regularly receive positive feedback, their practices could be shared as best practices across the team.

Having a data-driven decision-making process allows you to adapt your strategy based on your customers' current needs and expectations to continuously improve your financial services.

Significance of live chat in financial services

Swift customer support

In the financial industry, transactions and information are time-sensitive, and slow customer support can make customers unhappy. Live chat tackles this problem by offering real-time, quick answers to questions about customers’ accounts, transactions, or anything else they need help with.

Time and cost efficiency

The AI-powered features in live chats can handle more inquiries without compromising service quality, improving customer service, operational efficiency, and cost-effectiveness. Letting automation handle routine tasks also allows you to allocate your human resources strategically and focus on areas that require expertise, ensuring you use human talents where they matter the most.

Building trust

Live chats can help a financial institution understand the customers’ unique requirements, past interactions, and preferences. It uses this data to provide information tailored to each customer’s needs and inquiries, making them feel taken care of.

For instance, if a customer frequently inquires about certain financial products, a proactive live chat system can suggest related offerings during subsequent interactions. This level of personalization lets customers know you are attentive to their needs, contributing to a positive customer perception and building trust.

Visual assistance with co-browsing

Customers often need assistance navigating online platforms or understanding intricate investment strategies. Instead of relying solely on verbal explanations, co-browsing allows agents to guide clients through processes with visual tools like video chat, graphs, and images, creating a more immersive experience. When customers can visually see the steps or understand the details of a financial strategy through charts and visuals, it enhances their trust in your company.

Prioritizing security

Customers need assurance that financial institutions safeguard their sensitive information and that sensitive information shared during conversations remains confidential. Live chat platforms use strong encryption protocols to ensure the communication channels are safe and private from unwanted website visitors.

Common live chat use cases in financial services

Direct customer support

Customer support remains the primary use of live chat for financial services. It removes communication barriers and allows customers to get assistance without waiting. It can quickly resolve account-related issues, transaction disputes, or general inquiries, increasing client satisfaction and loyalty.

Faster onboarding

When integrated into onboarding, live chat becomes a guiding companion for new clients. It simplifies the onboarding processes by sending clients real-time account setup and navigation assistance, reducing the learning curve and ensuring a smooth transition into the financial services websites.

Enhanced customer service experience

Customer service is not just about separate interactions but the whole journey. Live chat improves service by providing personalized help and solving problems faster. It keeps things consistently positive, so every time a customer deals with your organization, it's a good experience. Happy customers stick around and suggest the financial institution to others.

Strategic sales tool

Financial products vary, so customers often need help determining which ones match their needs and goals. Adding live chat to the sales process is a great way for customers to ask questions, get personalized suggestions, and understand your offerings better. For financial institutions, it helps you know what your customers need and guide them towards smart decisions.

A typical use case in the financial industry

Everything starts when potential clients land on a financial services website. The live chat window pops up to greet them with a personalized message and sends instant assistance tailored to the visitor’s needs.

If they are interested in investment products, the chat app integrates with the ecommerce platform, offering in-chat product recommendations based on their preferences.

During the conversation, the chatbot suggests connecting the website visitor with a live agent for more detailed assistance. When the agent joins the chat, they use the co-browsing functionality to guide the website visitors through the online application process.

After submission, the website visitors receive a chat summary with key details and additional resources for reference.

This case isn't just a scenario. It reflects how live chat can convert a lead into a customer by providing the correct information at the right time.

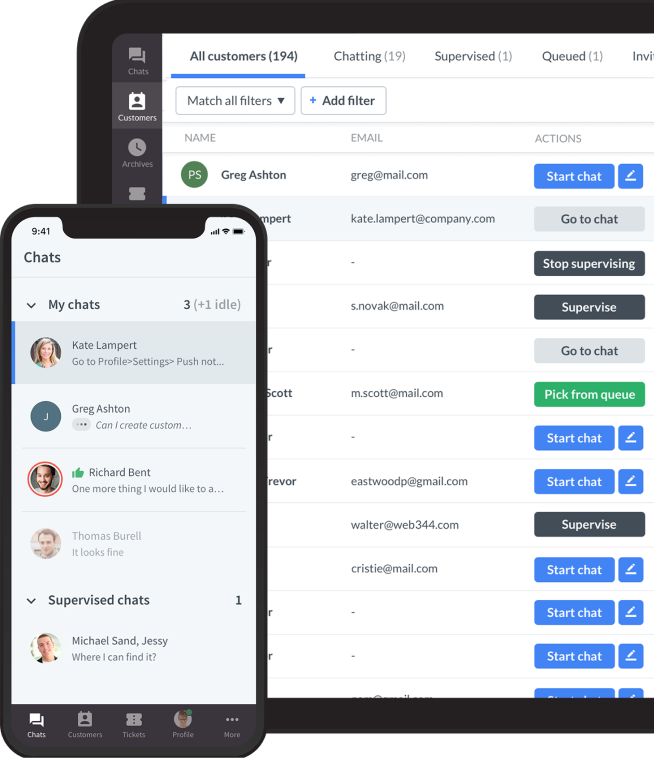

A chat tool that can help you

With a focus on swift support, LiveChat addresses queries and delivers real-time assistance, meeting the customer’s need for fast and efficient responses.

The platform's proactive engagement goes beyond traditional support and adds a personalized touch to each interaction, fostering deeper customer connections. LiveChat's integration capabilities across various communication channels and ecommerce platforms ensure customers can engage conveniently through the method of their choice.

The business tools offered by LiveChat are not just about issue resolution. They help build trust, cultivate better relationships, and show a commitment to exceptional service. With LiveChat's innovative approach, businesses can revolutionize customer interactions, making them seamless, swift, and uniquely tailored to individual financial needs.

Sign up today and explore how LiveChat's features can elevate your digital customer experience.

Conclusion

As financial companies navigate the ever-changing landscape, integrating a live chat solution becomes more than just a bonus feature; it becomes a strategic tool. It's a decision to improve customer satisfaction, streamline operations, and stay ahead in an industry where adaptability is vital.

The journey with live chat is an ongoing evolution where each positive live chat interaction contributes to a more efficient, customer-centric, and successful financial service provider.

Get a glimpse into the future of business communication with digital natives.

Get the FREE report

Comments